Enabling Scottish Impact Investing

The Bank

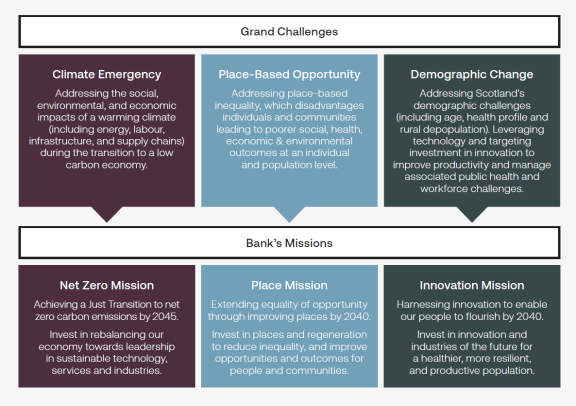

The Scottish National Investment Bank was launched in 2020 to provide mission led impact

investment to support the sustainable growth of Scotland’s economy and address three of

the most significant grand challenges facing Scotland over the coming decades – the climate

emergency, place-based opportunity, and demographic change.

Our missions are outcome orientated and serve as the primary filter through which our

investment decisions are made, supporting our investments to deliver both commercial and

mission-impact returns:

In this blog, which follows the publication of the Bank’s landscape report ‘Unlocking the potential of impact investing in Scotland’ and the 2023 Impact Report, Rebecca Diggle, the Bank’s Director of Impact, explores the potential for the growth in impact investing in Scotland.

The time has come

At the end of November last year, just after the Bank’s second year anniversary, we held the

Bank’s first conference focused on impact investing and launched our landscape review

Unlocking the potential of impact investing in Scotland. The culmination of this work provides

us with an opportunity to reflect on some of the lessons we have learned about the Scottish

impact investing ecosystem since our launch.

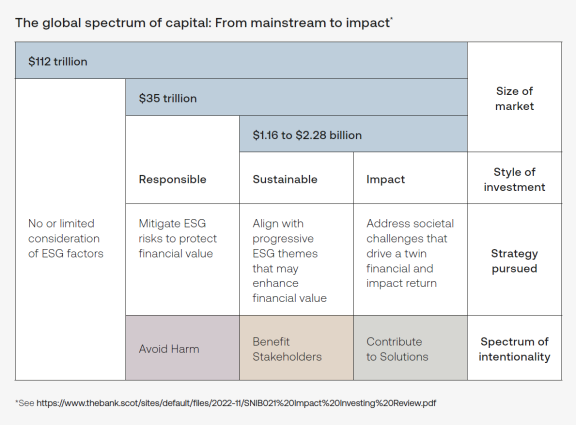

The momentum around impact investing has never been greater. Globally, there is over $1.164

trillion invested for impact and, as our report shows, in Scotland there is a growing market with

size estimates ranging between £1.8 billion (for more narrowly defined impact investments)

through to £6.4 billion (under a broader definition).

There is also increasing evidence that adopting an impact-oriented approach to investment has the potential to not only deliver significant societal and environmental benefits, but also a commercial return for investors. We therefore believe there is a significant and timely opportunity to accelerate this growth and create a dynamic, diversified impact investing ecosystem in Scotland, where ever-increasing flows of impact capital are being managed to meet national needs and bring global benefits.

Our organisation has much to contribute but we acknowledge that the complexity of the challenges facing Scotland means that our investments alone will not be enough to deliver solutions; they require a mix of public policy, private and third sector initiatives, delivered by a range of stakeholders drawing on both public and private finance to achieve the necessary scale and impact. We are therefore committed to work with others to support the growth of impact investing in Scotland to generate positive momentum in the investment ecosystem, harnessing more capital into projects and businesses that can deliver real world positive impacts.

It’s about the how and not the why

From the engagements we’ve had across the market, it’s clear that there are many business leaders across Scotland who recognise the economic opportunities that meeting these societal and environmental challenges create. These leaders also see the opportunity of impact capital as a source of investment which can fund transformational growth. Our current investees see their impact performance – in other words, the benefits to society and the environment – as central to their growth and business strategy needs.

The challenges are clear. Scotland needs to address systemic inequality and low productivity as well as transition to a low carbon future (with a 75% reduction in emission by 2030 and net zero by 2045). Collectively, these represent huge investment opportunities. For example, there is a clear and imminent opportunity to invest in the infrastructure and supply chain to support ScotWind, the programme of development which will see transformational growth in the amount of energy generated from offshore wind. These supply chain opportunities can drive sharp growth in employment within the renewables sector and support the Just Transition across Scotland.

The question for investees is not why, but how: “How do I scale and accurately represent the

impact that my business is delivering”? This is where there is a real opportunity for the Bank

to add value. As an active investor we work with our investees to ensure that they are fully

able to understand and report on Greenhouse Gas emissions and create credible net zero

plans and strategies. We support them to build inclusive and diverse workforces that reflect

Scotland’s ambitions for equality and Fair Work, and help them report and disclose this impact

performance to increasingly active and engaged stakeholders.

The question for investees is not why, but how: “How do I scale and accurately represent the

impact that my business is delivering”? This is where there is a real opportunity for the Bank

to add value. As an active investor we work with our investees to ensure that they are fully

able to understand and report on Greenhouse Gas emissions and create credible net zero

plans and strategies. We support them to build inclusive and diverse workforces that reflect

Scotland’s ambitions for equality and Fair Work, and help them report and disclose this impact

performance to increasingly active and engaged stakeholders.

The Bank can and should play a role here, and has a strong focus on supporting scaling businesses that typically require the larger size of deal that Scotland tends to see fewer of. As part of our position as an impact investor, the Bank seeks to demonstrate that its investments deliver commercial returns and demonstrable impacts, and that we can mobilise other investors. But in the longer term we also seek to provide confidence through demonstrating to other investors the reduced risk and strong returns available through the impact investing discipline – ultimately encouraging the Scottish impact investing market to scale.

Steps to enable the Scottish impact investment landscape

Scotland is already a leading financial centre with a large investment management industry,

a track record in responsible investing which is improving, with Edinburgh climbing 13 places

in the latest Global Green Finance Index and globally-relevant conferences, such as Ethical

Finance Global. What would it take to make Scotland a leading hub for impact investment?

Based on our experiences over the past two years, and our recent research into the impact

investing landscape, we see the following as enablers of transformative change that would

drive momentum, scale and ambition in Scotland:

◆ Practical support and active engagement: Businesses that are scaling rapidly typically do

not have advanced reporting functions that can measure the positive impacts that they are

making. So, investors need to take the time and develop easy to use resources to support

their investees. This can be technical/content-led advice; guidance around reporting; how

to enable Fair Work practices; or practical steps on how to create an inclusive and diverse

workforce or capture the climate and environmental impact of their companies and supply

chains. Our experience suggests that many companies welcome this support on their

impact journeys. The reality is that paying attention to these dynamics in businesses can

be helpful for future growth as increasingly other investors and rounds of capital look to

capitalise on credible impact performance.

◆ Leveraging the efforts of existing investors: The ecosystem of investors in Scotland who

are supporting more sustainable and impactful private sector activity is growing - and their

requirements and support can be leveraged. This includes the grant, equity and public

sector loan-enabled support from the Enterprise Agencies, who support start-ups and

businesses at the early stage of their growth. This public sector support is complemented

by private sector businesses providing a strong foundation for a healthy support ecosystem

in Scotland which those seeking to develop their impact investing skills can leverage.

◆ Standards and reporting consistency: There is a seismic shift emerging around defining

and evidencing credible approaches to impact investing that will create clarity in what

is being achieved and in the ways in which investors can demonstrate their role and

additionality. The Bank has adopted the Principles for Impact Management as the process

through which it can demonstrate how impact is hard wired into investment decisions and

portfolio management. We will also begin reporting on climate change commitments via the

Task Force on Climate-related Financial Disclosures (TCFD) in the coming year. More broadly,

the Financial Conduct Authority pursuit of credibility to protect against greenwashing via

the Sustainability Disclosure Requirements (SDR) will help clarify what and how impact

claims can be justified. The Impact Investing ecosystem needs to avoid a confusion of

standards and reporting frameworks and instead drive for an agreed upon, practical set

of measurements that serves Scotland’s needs and creates consistency and efficiency in

impact claims.

The Bank’s vision for impact investing in Scotland

And the Bank’s role in all of this moving forward? We have a unique mandate to help transform Scotland’s economy, having been created as part of a strong commitment to use our investments to create impact in Scotland. We will demonstrate through our investments that impact can be delivered along with commercial returns, ultimately providing confidence to a broader swathe of investors (including those charged with deploying and managing institutional capital) that Scotland offers attractive opportunities to invest with Impact.

We are very keen to work with likeminded investors who are interested in creating impact and solving for the challenges we face in Scotland in Net Zero, Place and Innovation. And we will continue to support the broader growth of impact investing as a discipline within the Scottish Financial Services sector.

The information contained in this document should not be considered as an offer, solicitation or investment recommendation regarding any security or financial instrument. It is not intended for distribution or use by any person or entity who is a citizen or resident of, or located in, any jurisdiction where such distribution, publication or use would be prohibited. Nothing herein constitutes investment, legal, tax or other advice and is not to be relied upon in making an investment or other decision. You should consult your own professional adviser if you require financial, investment or other advice. Issued by Scottish National Investment Bank PLC (SC677431) at Waverley Gate, 2-4 Waterloo Place, Edinburgh, EH1 3EG.