2023 Impact Report

This report sets out why and how we invest, and provides an overview of our 2022 impact performance. It identifies the steps we will take in 2023 and in subsequent years to maximise our impact as an investor, and to support both the delivery of our missions and to evidence our progress towards meeting them.

Overview

As a development bank, our performance is demonstrated in large part by the impact we have made and the change in society we have driven. The Bank was established in 2020 to provide investment to address three grand challenges facing Scotland – the climate emergency, place-based opportunity, and demographic change – which our shareholder, Scottish Ministers, translated into three investment missions (net zero, place-based opportunity, and innovation). Our missions offer a strategic direction and focus for all our investment activity. They are outcome orientated and set out the impact that our investments are designed to enable over the longer term.

2022 was the first full year of impact reporting at the Bank. Delivering impact takes time but we are pleased to be able to share the results that we are already seeing across our portfolio.

- By the end of 2022, we had committed over £378 million of investment and mobilised a further £667 million, ensuring that within the first two years of the Bank’s existence we have enabled over a billion pounds of investment commitment to the Scottish economy.

- We have made significant progress in understanding and managing climate related impacts across our portfolio, including a commitment to adopt the Task Force on Climate related Financial Disclosure (TCFD) as our climate risk and reporting framework. We have already made investments which are forecast to generate over 3,332 GWh of renewable energy on a rolling five-year period, which is equivalent to powering one third of all Scottish households. Our investments are also forecast to avoid, reduce or remove over 18 million tCO2e over the lifetime of our existing portfolio (that’s the equivalent of over 470,000 full capacity, return flights from Glasgow to London).

- Our investments have directly impacted businesses and communities in 20 Scottish Local Authorities, and 100% of the businesses and projects we have directly invested in have committed to adopting Fair Work First Principles, that ensure high-quality employment for Scottish workforces.

- We are actively investing in companies that seek to grow the Scottish innovation ecosystem through the development of new products, processes and technologies, and since launch our investment has supported 43 patents.

Proving that impact investing enables material commercial returns along with social and environmental dividends is increasingly important and urgent.

The landscape review we published in 2022 found that there is already at least £1.8 billion of funds invested in impact businesses and projects in Scotland, but also that there are significant volumes of funds that could be further deployed towards impact investment.

It is our intention that by showcasing our social and environmental impact as an investor, and by continuing to work collaboratively with other investors, we will support the growth of impact investing in Scotland. This in turn will help more finance – including private, commercial finance – to flow into businesses and projects that will ultimately benefit Scotland’s people, places, and environment.

Impact Performance Summary

Mission Delivery Overview

During 2022 we:

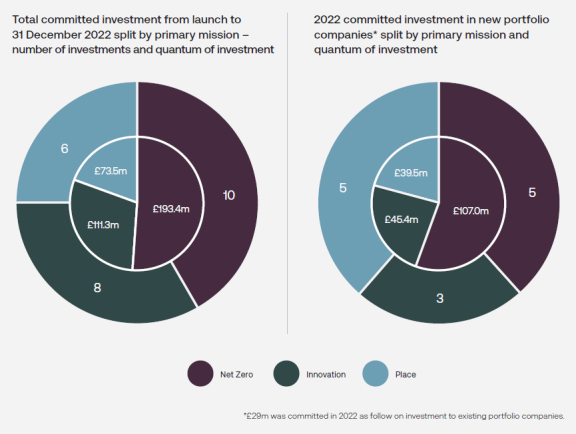

- Supported 13 new businesses bringing our total portfolio to 24.

- Committed £220.9 million investment capital, including £191.9 million to new businesses and projects, bringing our total investment committed since launch to £378.2 million.

- Supported £201.1 million third-party capital, bringing the total amount of third-party capital associated with our investments since launch to £667.1 million.

- Directly supported around 1,200 jobs. The indirect and induced impacts from the Bank’s investment supported a further 1,100 jobs across the Scottish economy.

Portfolio impact performance from November 2020 until 31 December 2022:

Net Zero

- 50% of our total investment portfolio contributed to the shift to a net zero economy.* (£227.2 million since launch)

- Our investment portfolio had generated approximately 1.8 GWh of renewable energy, powering the equivalent of 472 homes in a year.

- Our investment portfolio has avoided, reduced or removed approximately 5,006.3 tCO2e, the equivalent of 126 full capacity, return flights from Glasgow to London.

Place-Based Opportunity

- 50% of our total investment portfolio contributed towards improving place-based opportunity.* (£281.1 million since launch)

- 100% of the businesses and projects directly invested in had committed to adopting Fair Work First Principles.

- 20 Scottish Local Authority areas had benefitted from our investment.

- Over £16 million supply chain spend was reported by our portfolio companies as having been spent in Scotland, which equates to an average of ~58.5% of all supply chain spend reported.

Innovation

- 50% of our total investment portfolio contributed towards developing the Scottish innovation ecosystem.* (£97.9 million since launch)

- 43 patents had been reported as being supported by our investment since our launch.

- 100% of our investment portfolio who contributed to developing the Scottish innovation ecosystem introduced new product, process or technological innovation to their business in 2022.