The Bank’s investment strategy forms part of the core strategic framework in which the Bank is governed, operates and reports.

To meet the terms of the Shareholder Relationship Framework, the Bank’s investment strategy is reviewed and approved by the Bank Board on an annual basis, and otherwise as necessary, to take account of any additional or amended obligations or responsibilities assumed by the Bank and its Group which are material in nature.

Download the report

Investment Strategy 2025 - 2026

Introduction

Our strategy is designed to meet both short and long-term goals; we are aligned in identifying key investment themes and sectors that will support our impact ambitions, while also building a portfolio with financial returns that will enable the Bank to achieve its aspiration to become the perpetual investment fund for Scotland.

In this document we have set out our priority sectors for the coming period, under each of our three missions. These are outlined to give guidance on our focus for the year. We have identified these sectors as having high potential for achieving impact that will make a difference for Scotland, as well as commercial returns. Our investments won’t be limited to these sectors, and we will consider all opportunities.

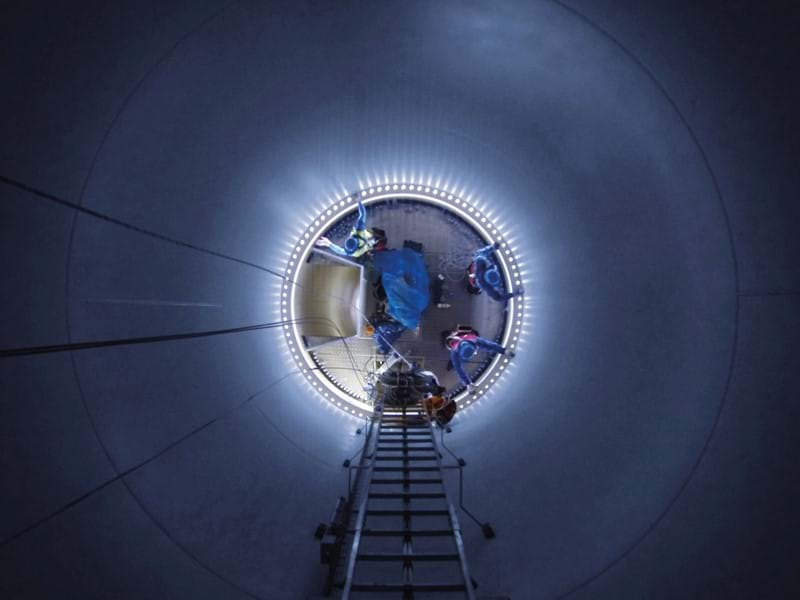

In line with our continued commitment to ScotWind, and with the additional capital committed by the Scottish Government, we have detailed the ScotWind related sectors that we are looking to invest in. We have also detailed our criteria for project finance for the first time. These project finance deals are not limited to ScotWind-related projects and we expect to be able to deploy capital to other critical infrastructure projects.

Our commerciality is important as we continue to build a strong portfolio. The criteria in this document are detailed to allow us to focus our efforts on making investments with clear opportunities for commercial returns. Our aim is to build a perpetual fund for Scotland that aligns with our commercial goals and stretching impact ambitions.

In refining this strategy and our focus, I’m pleased that we can clearly communicate our ambition for the coming period and give direction to the organisations considering investment. It reflects the maturity and knowledge we are building as a team and organisation. However, we still have much more to do and I am excited to continue building on our work.

Mark Munro

Chief Investment Officer

Investment key principles

Our investment activity is shaped by four key principles:

Mission impact

The Bank is a mission impact investor, seeking commercial, societal and environmental impacts from its investments.

Patient capital investor

Where needed the Bank can be a patient capital investor, investing on longer timeframes to realise the impact of the investment.

Crowding in

The Bank seeks to catalyse economic activity by investing alongside private sector investment, or ‘crowding in’.

Commercial terms

The Bank invests £1 million up to £50 million in businesses and projects across Scotland on commercial terms.

Investment criteria

Priority sectors

The below shows the key sectors we have identified for active origination over the coming period. These are outlined in more detail on page nine of the Investment Strategy Report. We are open and reactive to investing in other sectors so far as they align with our missions and portfolio.

Our investment criteria

Key criteria that apply to all investments are;

- Proven management team – proven delivery in a relevant sector.

- Technology Readiness Levels (TRLs) – in most cases TRL 8 or higher.

- Additional investment – we will look to bring other investors alongside us.

- Revenue generating – for equity or corporate debt investments, considerations will be made for project finance.

Additionally, each of our investment instruments also has focused criteria. See pages 10 to 14 of the Investment Strategy Report for details.

Investment strategy principles

We invest for impact:

- We align all investment against our missions and wider social and environmental impact objectives.

- We are an ethical and responsible investor. We use our Responsible & Ethical Investment Policy and ESG standards to guide our investment decisions.

- We are a Signatory to the Operating Principles of Impact Management (OPIM) and have integrated impact considerations throughout our investment lifecycle.

- We work with other impact investors, including other development banks, to develop the field of impact measurement, and work to support the growth of impact investment in Scotland.

We invest on commercial terms:

- We invest on commercial terms with appropriate returns set at the individual investment and portfolio level. Investments will include covenants and protections for our capital in line with market norms and the risk profile of each investment.

- We are a patient investor, investing patient capital in businesses and projects across Scotland.

- We invest between £1 million and £50 million with a focus on debt and equity investments that support our missions. From time to time, we will also invest in funds aligned to the Bank missions and portfolio requirements. By exception, we may invest outside of these financial parameters where a business or project has particularly strong mission alignment or specific locational benefit to smaller and more remote communities.†

- We understand that the higher risk appetite in our role as Scotland’s development bank will inevitably lead to individual investment losses, however, positive net returns across the whole portfolio will demonstrate our stewardship of public capital.

- We aim to generate sufficient income from our investments and investment related activity to cover our operating costs by the end of the first five financial years and become financially self-sustaining.

- We will, subject to Shareholder approval, reinvest repaid capital investment and any profits we make back into mission impact investments, creating a perpetual investment fund for Scotland.

We invest to leverage private capital:

- We comply with subsidy control requirements. We apply measures to ensure we are not crowding out private sector finance and actively seek to ‘crowd-in’ other investors alongside our public capital to help catalyse critical economic activity in pursuit of our missions.

What we don’t do:

- We don’t provide grant or sub-commercial funding.

- We don’t provide government guarantees.

- We don’t consider new investment into distressed businesses or projects, or those in need of emergency financial support.

- We don’t provide retail banking or deposits to individuals or micro businesses.

*We have additional capital to make investments that are focused on the ScotWind supply chain. We are focusing on investment into infrastructure such as ports, manufacturing businesses and services that will support the sector to establish in Scotland.

†The Scottish Government Urban Rural Classification defines ‘Remote’ areas as those that are more than a 30 minute drive time, or areas that have a drive time between 30–60 minutes from a Settlement with a population of 10,000 or more. Additionally, ‘Very Remote’ is defined as areas that are more than a 60 minute drive time from a Settlement with a population of 10,000 or more. (Scottish Government Urban Rural Classification 2020 (www.gov.scot))