How the push towards Net Zero could create a windfall for Scotland’s economy

The Bank

The Scottish National Investment Bank was launched in 2020. The Bank focuses on investing in businesses, projects and communities across Scotland that support the development of a fairer, more sustainable economy. In keeping with this, all investments must deliver both commercial and mission-impact returns, supporting at least one of the Bank’s missions:

ScotWind – a powerful investment opportunity

ScotWind is the first round of Offshore Wind Leasing in Scottish waters for a decade.

The ScotWind programme will lease areas of the seabed around Scotland for wind farm developments. Developers apply to the scheme and, if successful, they will be granted the rights to build wind farms in the Scottish sector of the North Sea.

A first licensing round that exceeded all expectations

In January 2022, the results of the ScotWind licensing round were announced, and saw around £700 million paid in option fees for 17 projects in Scottish waters. The round was a huge success with 25GW of offshore wind proposed, the majority floating. (A gigawatt, or GW, is equal to one billion watts.) In April, Crown Estate Scotland announced a “Clearing Round” for the unlicensed acreage with the possibility of going higher than 25GW. Results from the clearing round are anticipated in Autumn 2022. Final investment decisions on the projects will be reached towards the middle of this decade with build-out scheduled to last until late 2033. Potential stumbling blocks may include (onshore) grid connections, challenging economics, and supply chain constraints. Nevertheless, the first round was a huge success and all stakeholders are incentivised to deliver 25GW.

Delivering on 25GW

Decreasing friction in the market can help realise the goal of delivering 25GW. Achieving full commercial scale on floating offshore wind developments will also be a significant milestone, with positive implications for the global offshore wind market, and an opportunity for Scotland to export its expertise internationally.

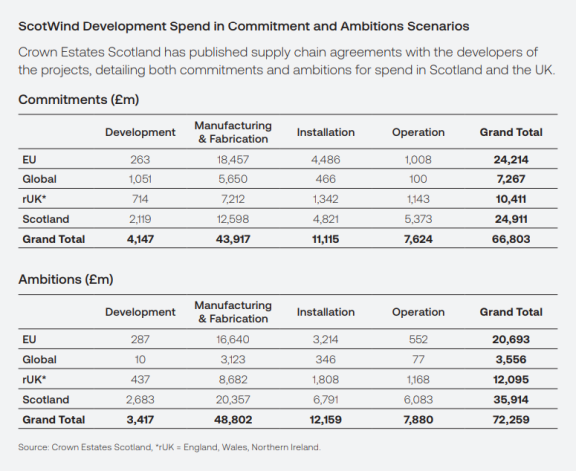

Creating partnerships to meet commitments on spend - and drive down costs

The Bank is looking to collaborate with partners across Scotland, from both the Public and Private sectors, to ensure the commitments to Scottish spend are met.

The aim is towards the ‘Ambitions’ level, which would result in an additional £11 billion in spend in Scotland over the coming decades, and enable Scottish businesses to scale-up for export markets.

At the same time, the Bank will also be working with entities across the sector to drive down the cost of ScotWind. By doing so, it’s possible to provide benefits to consumers and households in Scotland, as well as the rest of the UK. Decreasing the cost of developing wind projects cascades down to lower household bills.

The Bank also wants to speed up the energy transition on a global basis through lower-cost floating wind developments. Investment in the supply chain is vital, and the aim should be to maximise Scotland’s contribution while innovating to drive down the cost of project development.

Aligning activity with our missions

Over the coming months the Bank will liaise with stakeholders across the offshore wind and oil and gas supply chains. We will work together to ensure that the supply chain is investment-ready at the point of final investment decisions, helping to anchor as much of the ScotWind supply chain in Scotland as possible. This will also help promote the Bank’s Places mission by ensuring a Just Transition across Scotland – most notably for the North East - alongside our Net Zero mission.

Opportunities and considerations

Key to developing the supply chain in Scotland will be the manufacturing and fabrication sectors. Much of the development - be it consulting, legal, or survey - involves areas where Scotland already has strengths. Likewise, the operations market will be difficult to export overseas on a wholesale basis, and therefore presents an opportunity for local investment.

Anchoring manufacturing and fabrication work in Scotland requires investments in cable manufacturing, ports, cranes, and staging areas. Rotors, nacelles, and towers may also come to Scotland, and the Bank would carefully examine the potential for investment with the desire to support this. Building on the country’s existing capabilities in the oil and gas space is likely to lead to better results for consumers, developers, and the supply chain alike. These sectors also have strong future export potential beyond ScotWind.

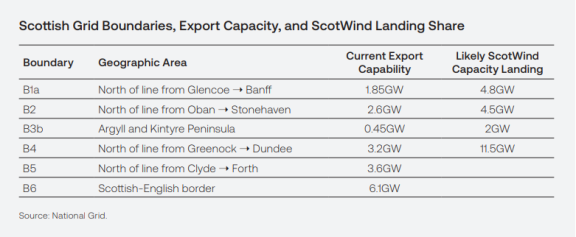

Fast grid upgrades crucial to development

◆ Preventing loss of energy by limiting curtailment

Even before the ScotWind results were announced, the electricity grid in Scotland required (and was undergoing) significant upgrades to capacity. These upgrades are necessary to enable the development of onshore and offshore wind, and prevent curtailment of wind energy. Curtailment occurs when there is an excess of wind generated energy available, compared with what the system requires. In effect, it ‘turns down’ or even switches off the electricity generation. By reducing the level that well-functioning wind turbines are capable of producing, curtailment results in a significant loss in economic and energy efficiency.

◆ There’s a need to upgrade capacity - fast

The success of the ScotWind licensing round makes these upgrades - and further improvements - even more vital, as much of the licensed area will continue to see curtailment on a regular basis. Many consider that upgrades to the grid are taking too long, and must be accelerated for a successful energy transition.

◆ A flexible approach and faster planning can improve on issues

By enabling more power to move from areas of supply to areas of demand, it’s feasible to accelerate decarbonisation and make renewables in Scotland more attractive to investors.

◆ Exploring the green hydrogen space

Some developers may avoid grid connections, and target the electricity to hydrogen market instead. This could prove successful over time, but is likely to make the economics of developments more challenging in the near term. With this in mind, the Bank also intends to work with the supply chain and businesses across the green hydrogen space.

In conclusion

Developing commercial pathways, and building scale in the sector, could lead to a significant return of industry to Scotland. To facilitate this, the Bank is urging for grid upgrades and faster grid connections to be prioritised as a matter of urgency.

It’s possible to reduce carbon at a much greater, and faster rate, with the ensuing benefits for the public. However, this requires a more flexible approach to grid connections, and speedier planning decisions - giving surety to investors, and a faster pathway to lower bills for consumers.