Working with Developers to Maximise Scottish Impact & Embed the Energy Transition

The Bank

The Scottish National Investment Bank was launched in 2020. The Bank focuses on investing in businesses, projects and communities across Scotland that support the development of a fairer, more sustainable economy. In keeping with this, all investments must deliver both commercial and mission-impact returns, supporting at least one of the Bank’s missions:

This is the second in a series of blogs the Bank is intending to publish relating to ScotWind, offshore wind in general, and how the Bank can promote the healthy development of the market. The first blog covered the scale of ScotWind, the success of the round, and the challenges to delivery. This piece examines the commitments developers have made to the Scottish supply chain and the wealth of knowledge the sector can lean on to scale the sector.

INTOG to ScotWind and Beyond

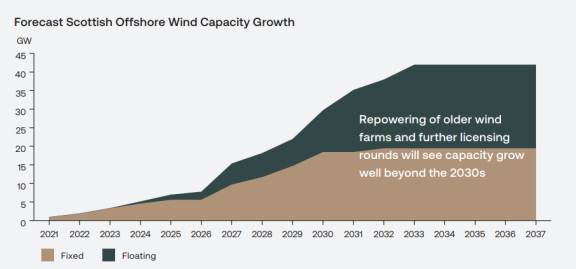

Scotland is set to see almost 40GW of offshore wind deployed by the mid-2030s, with the majority of that floating. The Innovation and Targeted Oil and Gas (INTOG) leasing round calls for up to 4.5GW of (likely all floating) offshore wind to decarbonise the upstream oil and gas sector, with 500MW of capacity directed to hydrogen production and other innovative technology. This round will see commissioning start before the first ScotWind projects have begun construction, and can therefore be a proving ground for the Scottish supply chain; this means there is a need to invest now in order to start to build capability and capacity in the supply chain. The 28GW of capacity anticipated for ScotWind, including the newly announced floating projects from the clearing round, will be built over the next decade, with construction lasting into the early 2030s. At some point the existing wind farms will go through repowering, adding further demand. And given the far higher demand for electricity in the future through the decarbonisation of domestic heat and personal transport, alongside industrial heat and other modes of transport, further rounds will be required in the late 2020s and early 2030s to continue the build-out of renewables in Scotland.

Investments in the supply chain for ScotWind are not simply targeted at ScotWind. Prudent, patient capital investments now can accelerate decarbonisation, anchor skills and industry, and serve the Scottish offshore wind and adjacent sectors for decades to come. There is a long, growing, and reliable pipeline of work for the supply chain in Scotland. The challenge is in ensuring the Scottish supply chain is ready and capitalised to take on the projects. The infancy of floating wind technology provides an opportunity for the skills and industry developed in Scotland to then be exported later this decade. The Bank is eager to engage on this with stakeholders from across the public and private sector supply chain.

Ensuring Delivery, Anchoring Industry

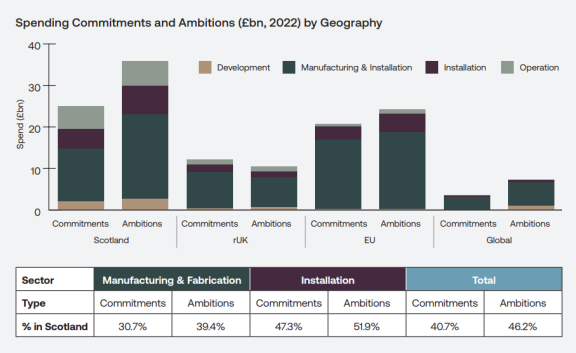

The chart below shows spending commitments for ScotWind. The data comes from the ScotWind Supply Chain Development Statements, with each developer laying out the spend they are committing to Scotland and other geographies, and their ambitions to go beyond this in Scotland.

Scotland is expected to see around 30% of Manufacturing and Fabrication spend, over 45% of installation spend, and 40% of total spend on ScotWind. Reaching the ambitions level could push these up to around 40%, 52%, and 46% respectively.

Over the construction period and out to six years after commissioning, developers have committed spend in Scotland of almost £25 billion, the equivalent of £1 billion for every 1GW developed. The Bank seeks to work with developers and the supply chain across Scotland to ensure the supply chain is investment ready thereby ensuring the benefits are delivered. Going further the Bank, working to crowd-in capital from developers and other interested parties, can also help to drive spend towards the ‘Ambitions’ level, potentially resulting in an extra £10 billion in spend in Scotland - with the resulting benefits in employment, to the public purse, and in exports.

Most of the increase attainable comes from the Manufacturing & Fabrication stage of development, with almost £8 billion of additional spend in Scotland possible. Much of this spend can happen some distance from the assembly point, so the benefits of ScotWind can be felt across the whole of Scotland.

Getting this right, by investing in Scotland’s offshore wind supply chain in the near-term, not only anchors more spend for ScotWind in Scotland, but also contributes to the future of the offshore wind sector as a whole. The export market for offshore wind will continue to grow for many years, with potential for more than 1TW to be installed globally by 2050. Floating offshore wind will become a growing part of that market. Investments in the Scottish Supply Chain – whether skills or infrastructure – will be exportable over the decades, promoting a Just and Lasting Transition to the North East and the rest of the Scottish economy.

The Oil & Gas Knowledge Economy: A Key Advantage

Scotland is a global expert in the subsea market for oil and gas. The development of the North Sea through subsea tiebacks and engineering work out of Aberdeen and the surrounds to develop deeper water fields in West Africa and elsewhere has gifted Scotland with deep knowledge of a strategically vital area. This sector has key crossovers of knowledge into the floating offshore wind sector, with anchors, subsea arches, robotics, and a host of other niches where the industry around Westhill in Aberdeenshire excels. Using this knowledge, building on the expertise to enhance the Scottish supply chain for ScotWind and to cut costs for developments, will benefit not just the North East but also households across Scotland through lower energy bills in the future. The knowledge in how to support the subsea market extends beyond Aberdeen and even Scotland, with finance and other entities in the rest of the UK with deep knowledge of the sector, the risks, and an appetite to deploy capital into the sector which must be maintained through the transition. Deploying technology automation into the supply chain to drive productivity gains will lower costs. Using innovative materials for ropes can mean faster build-out of projects. Ensuring sufficient crane and laydown capacity can turn floating turbine construction into a production line process, with the accompanying efficiencies.

The Bank has already invested £30 million in the Port of Aberdeen – a strategic asset for ScotWind and Scotland’s energy transition over the coming decades. The Bank can work with partners across the public sector, financial and supply chain space to not only reach, but exceed the ‘Ambitions’ share of spend. Ideally this would also lead to cutting the cost of floating offshore wind faster than anticipated. Investing early to provide capacity and prepare the infrastructure for the mid-2020s is vital to the process, and the Bank is eager to work with entities across Scotland and the UK to achieve these goals.