ScotWind 2.0, Wind Farm Repowering, Scotland’s Long-Term Growth

The Bank

The Scottish National Investment Bank was launched in 2020. The Bank focuses on investing in businesses, projects and communities across Scotland that support the development of a fairer, more sustainable economy. In keeping with this, all investments must deliver both commercial and mission-impact returns, supporting at least one of the Bank’s missions:

This is the sixth in a series of blogs the Bank has been publishing in relation to ScotWind, offshore wind in general, and how the Bank can help in developing the market. The first covered the scale of ScotWind, the success of the round, and the challenges to delivery. The second piece examined the commitments developers have made to the Scottish supply chain and the wealth of knowledge the sector can lean on to scale. The third looked at the key infrastructure required to deliver ScotWind and how the Bank is aiming to support the market in advance of Final Investment Decisions while the fourth instalment examined the adjacent technologies which can deepen the transition in Scotland and beyond. The previous piece looked at technologies for cutting costs in offshore wind and increasing productivity and safety in the sector.

This blog covers the longer-term future for the Scottish offshore wind market, into the late-2030s and beyond. It also looks at how the Bank is investing to ensure Scotland’s supply chain can continue to develop.

Floating Costs Will Sink

The fixed bottom offshore wind market has made spectacular strides in cutting costs over the past decades. Scale has allowed the market to become more efficient, expand into deeper waters, and into less energy-dense areas, while remaining economically viable.

The development of floating offshore wind is an extraordinarily exciting opportunity. Scaling industrialising, and improving this relatively new technology provides a large homegrown market for Scotland to experiment and learn within. Scotland has some existing advantages in the floating offshore market, not least the learnings from the deepwater oil and gas market over the past few decades which can be applied to the development of this new sector, and the North East of Scotland in particular has a strong comparative advantage here.

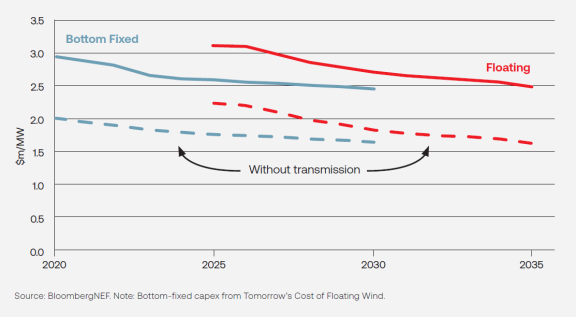

A sizeable long-term opportunity is in the industrialisation of the offshore wind market and applying assembly line processing to floating offshore wind. This could see floating offshore wind become cost-competitive with fixed-bottom offshore wind, requiring fewer vessel days during the installation phase, and coming in at lower cost per MW. Learning rates are expected to drive floating offshore wind costs down to fixed-bottom costs by around 2035.

Learning how to make floating offshore wind as cheap as fixed-bottom provides a great opportunity for Scotland to then export these skills and technologies to the rest of the North Sea as well as globally. This can be a boon to the growth of the future Scottish economy and for delivering on the principles of a Just Transition through skilled, green jobs.

Part of cutting costs in the floating offshore wind market will require a rationalisation of floating turbine designs. Currently there are more than 40 worked-up designs – concrete and steel, spar, tension leg platform (TLP) and semi-sub – and reducing these down to a few, accounting for variations in water depth and sea state, will help to industrialise the market and cut costs for consumers.

Repowering, Exports, and ScotWind 2.0

A huge amount of infrastructure – from ports to training centres, to factories for blades and nacelles – is required to deliver on ScotWind. The exact investment requirement depends to an extent on upcoming Contracts for Difference (CfD) rounds and expected attrition to the 29GW of Scotwind, as well as the 4.5GW+ currently expected for the upcoming Innovation and Targeted Oil and Gas (INTOG) leasing round – but, regardless of the outcome, the market is expected to grow substantially both in Scotland and globally.

Some of the developing infrastructure will be for specific technologies which will eventually become obsolete as larger blades and turbines are designed, but nevertheless has a key role in the shorter-to-medium term. Some infrastructure will continue to serve the offshore wind market and broader marine economy, for decades and possibly centuries to come. Future repowering of existing offshore wind assets, for example replacing smaller turbines with larger ones and either cutting turbine numbers or installing larger cables, can result in a contribution to the grid with a lesser impact on the rest of the marine economy (for example, fishing and the Blue Economy). In other words, renewing a 500MW wind farm made up of 63 smaller turbines with to 25x20MW turbines can enable a more efficient use of the seabed without a cut in electricity generation.

Exports from the Scottish market will vary by the exact sector; it is likely to be difficult to export fully assembled floating turbines. However, the parts and services connected to the turbines are easier to export and Scotland can build an early advantage in the larger turbine and floating offshore wind space. Infrastructure built for ScotWind can service not only ScotWind, or INTOG, or the repowering of existing wind farms, but also the export market in the North Sea, Baltic Sea, and beyond.

At 29GW, even accounting for some generation being diverted to hydrogen generation, ScotWind would be more than enough to supply Scotland’s current electricity requirements. The export opportunity to the rest of the UK and mainland Europe can absorb the additional generation capacity. However, bearing in mind that electricity demand will rise in coming years as transport, heat, and other sectors of the economy are decarbonised, ScotWind should be more than able to meet this rising demand.

Even leaving aside the opportunities in repowering, the investments made to enable ScotWind will be long-lasting and add value for decades to come. Infrastructure built now can service that future market, both for construction and operations. Anchoring the supply chain in Scotland will pay dividends for decades – and possibly centuries – of future renewable activity. An example of this potential longevity is the Port of Aberdeen, which is the oldest company in the UK, dating back 900 years; the Bank has already helped secure the port’s future with a £35million investment and is eager to work with other key infrastructure projects connected to these future growth markets.

Decommissioning & Recycling

Building on decades of experience of oil and gas decommissioning in Scotland, we can plan in advance for how to deal with the end of life of offshore wind assets. The Offshore Renewable Energy (ORE) Catapult and Zero Waste Scotland estimate just under 4m tonnes of material will be required for ScotWind’s turbines. Steel is expected to make up 90% of the mass of 20MW turbines and it can be recycled, albeit not within Scotland at present. Historically, wind turbine blades could not be recycled. The current generation of blades are still difficult to recycle, but there are options, for example being blended into a feedstock for cement, cutting the emissions associated with a traditionally harder to decarbonise market. Future innovations that will serve to make the market significantly more environmentally friendly are to be welcomed. Decommissioning plans established during the construction phase of Scotwind therefore need to account for the whole life cycle and developers should publish and regularly update their end-of-life plans for wind farms.

The Size of the Prize

Analysis the Bank has commissioned shows delivering ScotWind will require billions of pounds to be invested in ports, harbours, cranes, manufacturing facilities, Operations & Maintenance (O&M) bases, skills, and technologies. This is a multi-decade project where the Bank is eager to support the market across Scotland and to help attract in additional third party capital, particularly for the early, but critical infrastructure upon which future economic opportunities will depend. The Bank’s three missions can all be advanced through targeted investments in the infrastructure and supply chain for offshore wind, and we will continue to engage with the many opportunities the market affords.