Last Updated: 18 April 2025

ABOUT THE BANK

In the Programme for Government 2017-18, the First Minister announced plans to establish a Scottish National Investment Bank. The Bank has the potential to transform Scotland’s economy, providing patient and growth capital for businesses and finance important infrastructure projects to catalyse private sector investment.

The Scottish National Investment Bank Act 2020 established the Bank and the Bank was launched before the end of 2020.

The Bank is a cornerstone institution in Scotland’s financial landscape providing finance to support inclusive, ethical and sustainable growth across Scotland. The Scottish Government has committed to providing £2 billion over 10 years to capitalise the Bank; this will make a material difference to the supply of capital to the Scottish economy.

The Bank takes a mission impact approach to investment which will help create and shape future markets, spark innovation and tackle socio-economic challenges. The missions, and therefore the strategic direction of the Bank, have been set by the Scottish Ministers, agreed by the Scottish Parliament and formally assigned to the Bank. The Bank’s Articles of Association reflect these missions.

The Bank’s purpose is aligned to the National Performance Framework. Tackling climate change is a priority for the Scottish Government and the First Minister announced in the Programme for Government 2019-2020 that the primary mission of the Bank is to support Scotland’s transition to net zero emissions by 2045. The Bank’s Board is responsible for setting out how it responds to the missions.

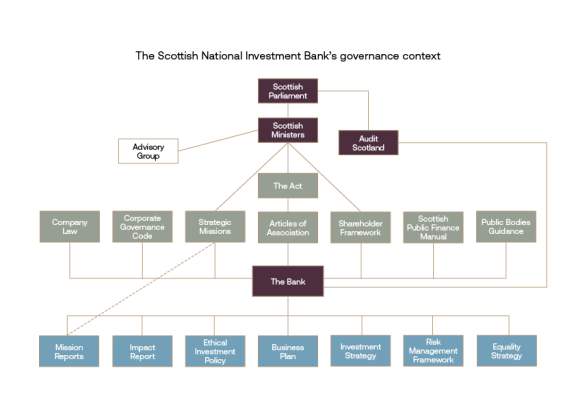

The governance structure of the Bank is unique with respect to the Scottish Economy. The Bank has been set up as both a public limited company and as a public body. The Bank is accountable to the Scottish Ministers (as the Shareholder) but has operational and administrative independence over investment decisions.

The Scottish National Investment Bank Act 2020 recognises that the Bank is both a financial services institution and a public body. It gives the Scottish Ministers the power to set the Bank’s strategic direction and to hold it to account for its performance in delivering against this direction but safeguards the Bank’s autonomy to decide how it invests to meet these objectives, its Missions.

The Bank is not authorised or regulated by the Financial Conduct Authority (FCA) or the Prudential Regulatory Authority. Scottish Investments Limited is authorised and regulated by the FCA (FRN: 942392) but does not provide any investment advice or personal recommendations.

Governance

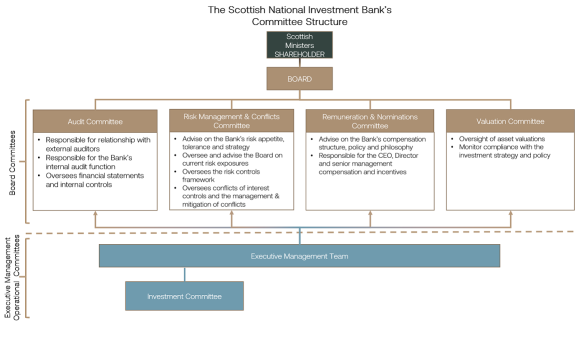

As a public limited company, the Bank has a Board of Directors made up of two Executive Directors and 9 Non-Executive Directors, one of whom acts as Chair of the Board.

The Board directs the Bank’s operations though an Executive Committee of senior managers who manage the Bank’s day-to-day business operations. The Board is accountable to the Scottish Ministers, as the Bank’s Shareholder.

The Board has formal committees in respect of maintaining strong corporate governance, namely:

- Remuneration and Nominations Committee

- Risk Management and Conflicts Committee

- Audit Committee

- Valuation Committee

As a public body, appointments to the Board are made by the Scottish Ministers.

The Board, Chief Executive and Executive Committee are responsible for the effective financial management of public funds and are required to account for the use of public money. The Scottish Public Finance Manual (‘SPFM’) covers all matters relating to public finance and reporting in Scottish public bodies.

In addition to the Act and the Articles of Association, the Bank has agreed a Financial Memorandum (which is consistent with the SPFM) and a Shareholder Relationship Framework Agreement, which together set-out the relationship between the Bank and the Scottish Ministers, as the Bank’s sole Shareholder.

Shareholder Relationship Framework Document

The Chief Executive of the Bank is the Accountable Officer and is therefore personally responsible to the Scottish Parliament.

Employees and Board members are expected to comply with the Bank's Code of Conduct.

HOW WE DELIVER OUR FUNCTIONS AND SERVICES

The Bank invests in businesses and projects that help support the delivery of its missions.

HOW WE TAKE DECISIONS

The Bank has a Board of Directors made up of two executive Directors (the Chief Executive Officer and the Chief Finance Officer) and nine Non-Executive Directors, one of whom acts as Chair of the Board.

The Board directs the Bank’s operations though an Executive Committee of senior managers, who will manage the Bank’s day-to-day business activities.

Executive Committee

The Bank’s Executive Committee is comprised of:

- Chief Executive Officer

- Chief Financial Officer

- Chief Risk Officer

- Chief Strategy Officer

- Chief People Officer

- Chief Investment Officer

- General Counsel

The Board is accountable to the Scottish Ministers, as the Bank’s sole Shareholder.

The Board meets at least 4 times each year.

The frequency of Board committee meetings is as set out in their respective Terms of Reference documents.

The Executive Committee (comprising the senior management team) meets on a weekly basis.

WHAT WE SPEND AND HOW WE SPEND IT

HOW WE MANAGE OUR HUMAN, PHYSICAL AND INFORMATION RESOURCES

The Bank’s recruitment activity is based upon an organisational plan and resource budget agreed with the Scottish Government. This organisational plan sets out the different functional teams required by the Bank and the management structure under which those teams will operate, led by a Chief Executive Officer. This structure includes a dedicated People & Culture function1.

The Bank has robust systems infrastructure and information governance arrangements.

HOW WE PROCURE GOODS AND SERVICES FROM EXTERNAL PROVIDERS

The Bank has established policies under which the Bank operates. This includes a formal procurement policy which governs how it selects external providers of goods and services to the Bank and has a dedicated procurement team. The procurement policy ensures that goods and services obtained by the Bank are objectively assessed for 'value for money'.

HOW WE ARE PERFORMING

OUR COMMERCIAL PUBLICATIONS

Currently the Bank does not produce any commercial publications.

1 The Bank comprises some 70 staff located in offices in Edinburgh and Glasgow and organised in a number of functional teams, including Investment, Finance, People & Culture, Governance, Legal Risk & Compliance, Portfolio Management, Partnerships & Engagement.