Net Zero Heat: A view from the Market

The Bank

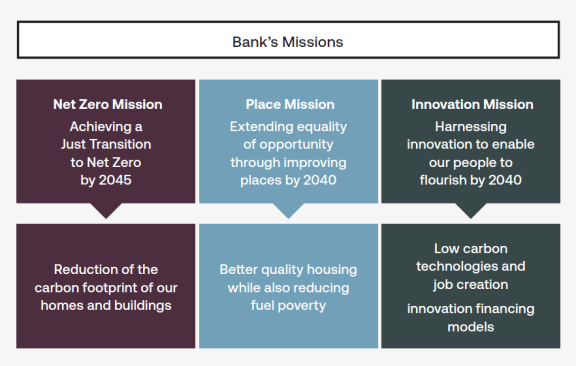

The Scottish National Investment Bank was launched in 2020. The Bank focuses on investing in businesses, projects and communities across Scotland that support the development of a fairer, more sustainable economy. In keeping with this, all investments must deliver both commercial and mission-impact returns, supporting at least one of the Bank’s missions.

Addressing Net Zero Heat supports all three of the Bank’s Missions

In May 2022 we released our report Scotland’s Transition to Net Zero Heat – in which we set out the nature of the challenge and significant opportunities for Scotland’s net zero heat transition, and looked at areas where further intervention from policy makers would help to either scale up or accelerate progress. We set out our work to date in investing in decarbonised heat and explored our role in the transition. This blog follows on to reflect on how the net zero heat transition is progressing and what we have learned from our extensive engagement with businesses, industry, policymakers and finance.

We have refreshed both our analysis of the context and need for a transition to net zero heat, and also the four main opportunities for us as a development Bank to focus our investments towards for maximum impact. In this first blog, we provide an overview of these – transitioning to net zero heat sources, reducing heat demand, utilising waste heat, and stimulating the supply chain.

Net Zero Heat – finding a route to scale and speed

Finding a means to accelerate the transition to net zero heat is critical to delivering on our climate change targets. Today, 81% of Scotland’s homes rely on mains gas, and heating and cooling buildings contributes over 20% of Scotland’s total greenhouse gas emissions. The recent Climate Change Committee report recognises the ambitious targets set by the Scottish Government in this area with positive progress having been made, particularly for heat networks. Nevertheless, the scale and pace of delivery remains challenging, and the Climate Change Committee has identified that there remains work to do to put in place policies sufficient to deliver on these targets. Anticipated legislation through the upcoming Heat in Buildings Bill and the implementation of the Heat Networks (Scotland) Act will therefore be critical for how it meets that challenge.

In addition to the speed of action that climate change demands, there is a real human need to push the scale and pace of delivery. Since the winter period of 2020/21 energy prices have soared from an average annual energy bill of £1,042 to £2,500 (as of October 2022) under the UK Government’s Energy Price Guarantee. As energy prices have risen, so has fuel poverty, with an estimated 35% of households affected. Added to the domestic human cost, there have also been concerns about security of supply, due to the impacts of Russian aggression against Ukraine.

These heightened energy prices therefore align both the requirement for net zero for Scotland and for lower costs for home heating for individuals. Whilst there is further work to do to reduce the costs related to decarbonising heat, including retrofitting buildings, the cost and net zero outcomes are more closely aligned than ever before.

1. Moving to net zero heat sources

In the simplest of terms, the main action needed to meet our climate goals is for the vast majority of buildings in Scotland and the UK to transition from fossil fuel sources of heat to low and zero carbon sources of heat. These can take many forms, from heat networks to electric-powered sources such as heat pumps, including both air and ground source, and thermal batteries. These can also be paired with renewable generation such as solar PV (for which there are VAT incentives when used in combination).

In order to ensure that there is a Just Transition to net zero heat, combining new heat sources with optimal use of insulation and other forms of “fabric first” interventions will be required. One of the problems that households have faced is that the price of retail electricity is higher than the cost of gas, creating a distortion in the pricing of energy where lower carbon sources (i.e. electric based heating) can be more expensive to run in poorly insulated homes. At the present time, properly installed, more efficient heat pumps will have a similar running cost to gas boilers under current energy prices.

However this will only last for as long as gas prices remain high, and so action is needed to adjust the relative pricing of electricity versus gas over the long term. The outcome of the UK Government’s Review of Energy Market Arrangements should address the pricing of energy to pave the way for low and zero carbon heating and realise the benefits of cheaper domestic renewable generation (which should ultimately become abundant). In addition to this, we continue to seek to support innovations and projects which would further lower the costs of the transition, with several areas of opportunity, including lowering manufacturing and installation costs alongside innovations which increase technology efficiency.

Heat Pumps

In off-gas grid areas that already rely on more expensive forms of fossil fuels such as LPG and oil, there have been for some time clear price and carbon efficiencies from transitioning to heat pumps. As noted, greater savings could be found in some properties by effectively combining heat pump installations with solar PV and electricity and heat battery storage.

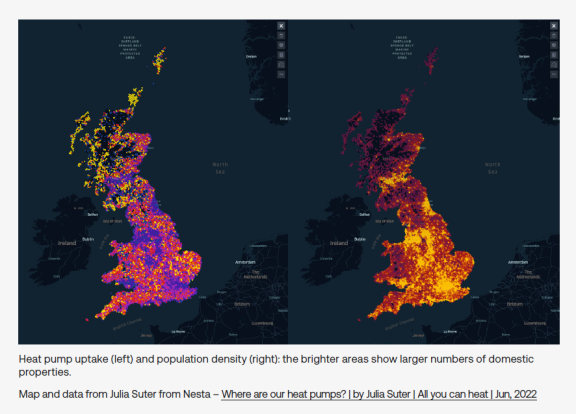

In fact, as you can see from the above graphic, the economics are such that heat pump uptake is already highest in rural off-grid areas (shown in yellow on the left, as a proportion of homes which have adopted heat pumps), with the Highlands and Islands of Scotland among the leading areas for heat pump installation. Grant funding for heat pumps through Home Energy Scotland is £7,500 or up to £9,000 for households which qualify for a rural uplift. Greater awareness of the economic case should be helpful in accelerating the transition from LPG and oil and there is scope for companies, who have the potential to scale to become regional or national service providers, supporting rural communities to make this transition.

Heat Networks

The growth of heat networks has been identified as a priority if Scotland is to meet its climate change targets. Developed properly, heat networks can significantly reduce the emissions impact of heat in both domestic and non-domestic settings, and can also help to lower the cost of providing large heat loads.

Currently, however, heat networks remain rare in Scotland and only provide around 1% of the country’s heat demand. The Scottish Government, through the Heat Networks (Scotland) Act 2021 and the Heat in Buildings Strategy, intends to support a significant scaling up of heat networks in the short and medium term, estimating that they will supply 2.6 TerraWatt hours (TWh) of output by 2027 and 6 TWh of output by 2030.

We are very supportive of ideas that will significantly de-risk heat network roll out, this could include licencing heat network companies as a utility, which would significantly reduce planning and operational risks. A critical issue will be to ensure that the framework which emerges leads to more feasible pathways to confirming the demand/load for any new heat networks, which will support cases for investment.

Heat networks currently require either a significant degree of acceptance of risk on the part of investors, or material amounts of grant funding. Significant and ongoing engagement with the public will be required in order to ensure acceptance and take up of what will be seen as a new way of heating our buildings. Denmark, particularly in Copenhagen, has shown what can be done to gradually increase public acceptance to the point where heat networks are the norm. One way of building momentum in this space would be to require or incentivise new and existing buildings (commercial, industrial and domestic) to connect to a heat network. This would provide confidence that heat networks will progress at an appropriate scale and pace. Public sector bodies in the vicinity of proposed heat networks should also take a leading and market-making role by connecting, providing both an anchor load and also reducing risk.

We will continue to engage widely to identify opportunities for the Bank to make investments in the expansion and greening of existing heat networks as well as the creation of new heat networks in Scotland. As heat networks are a well-proven technology which work commercially at scale in other countries, our role is in supporting and proving viable business models, building investor confidence, and encouraging and enabling private sector investors.

2. Reducing energy demand

Today around half of Scotland’s homes are below recommended standards of energy efficiency and new analysis states that one in every four pounds spent on heating in poorly insulated homes is wasted through leaky roofs, walls, windows and floors. A key route to ensuring a just transition to net zero heat is in reducing the amount of heat our buildings need in order to provide thermal comfort at an affordable cost. There are several routes to this, including improving building standards for new builds and retrofitting existing homes and buildings.

New Buildings

Although building standards are going to improve, and zero emissions heating systems will be required as standard in the future through planned legislation, the vast majority of houses being built today will likely require some form of retrofitting in the years to come, particularly to replace gas boilers. As a development bank, we are well placed to work with developers to start planning investment models for buildings with zero emissions heating systems and higher levels of thermal efficiency before planned changes come into force. We are already using our investment capital to ensure that new housing which we fund is heated with the lowest carbon emitting heat source which is practical for the development and has high levels of thermal and energy efficiency.

In terms of energy efficiency, very highly energy efficient houses are being built, but in very low numbers. Developers say that the cost is prohibitive, especially when it can be argued that the benefits accrue to the house buyers and the uplift is not considered to be recouped in an elevated sale price. However there is likely a lot more can be done with increasing skills across the design and construction industry in preventing thermal bridging and improving air tightness through design and construction which over time should lower costs. Over and above this, a range of studies show between a 1-10% uplift in costs to build to much higher efficiency levels. Scotland’s construction sector has an opportunity to work to lower costs but it will require sufficient scale in building and innovation in construction.

Very highly efficient homes should have a longer lifespan, far lower running costs (one study found Passivhaus residents bills were only £30 per quarter), and other clear benefits, for example on health and household economics. This means that building to higher standards with net zero heat as default is already of benefit to landlords who build houses for rental purposes because of the potential for lowering long-term maintenance costs and providing benefits for tenants. Building to high standards is possible and whilst capital uplifts may be required before achieving scale, we are interested to work with developers, and the social housing sector who want to lead the way by bringing highly energy efficient homes to the market.

Retrofitting

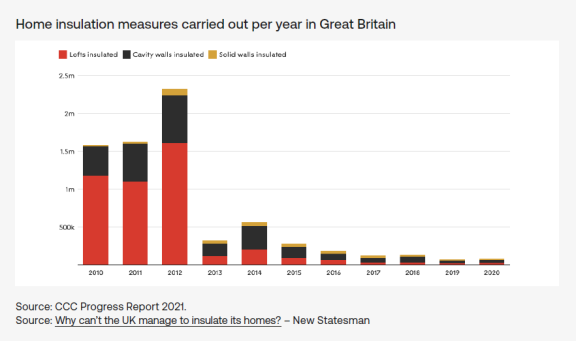

The vast majority of homes that will exist in 2045 are already built, and many will need significant upgrading to make them fit for the future. The current approach to upgrading our homes and buildings in the UK is not currently creating sufficient demand for energy efficiency upgrades or a transition to low-carbon heating. As you can see in the figure below, the removal of support for insulation in 2013 led to a sharp decline and subsequent plateau of installations of housing energy efficiency measures. This is costing many householders, with new analysis showing that these ‘missed savings’ added up to an estimated extra £2,150 cost per household bill in 2022.

The earlier an intervention to reduce energy and heat load, the earlier cost and carbon savings are achieved. In Scotland more financial support for homeowners is available than the rest of the UK through Home Energy Scotland’s loans and grant schemes. Despite this, our analysis is that the individual, building by building approach is not generating enough demand for retrofitting to stimulate markets and deliver the kind of pace and scale needed to meet articulated climate goals. Planned future regulation which sets high ambitions for energy efficiency improvements and connection to net zero heat sources with clear dates for the transition will drive this increase in demand. As we have seen with the phasing out of diesel cars, certainty is needed to stimulate the market, give the supply chain enough time to adapt and prepare for a rapid scaling up of demand, and provide the business case for investment. This expected growth will in turn stimulate innovations which can ultimately reduce costs.

In addition to stimulating demand, we are interested to invest in innovations that seek to scale delivery. We are actively engaging with the work of the Green Finance Institute, 3ci and Bankers without Boundaries which suggest some promising delivery mechanisms and approaches to finance that, if successful, could unlock vastly greater speed and scale that are fairer for the end user. However, these approaches are not yet delivery-ready, needing on-the-ground pilot and demonstrator projects to prove the model ready for a roll out at scale. We will continue to explore these wider approaches at scale where our capital can be of benefit. This may include providing backing to a central or regional entity which can coordinate place-wide retrofit programmes, or that include rolling out heat as a service.

3. Utilising waste heat

There are a number of major industrial sites close to population centres not presently taking advantage of their waste heat to supply those populations. Ensuring heat networks can interconnect and can offtake waste heat from industrial and commercial sites can improve the economics for both the industrial site and the heat network. This approach can scale from distilleries and breweries in the centre of Scotland’s cities, through to smaller distilleries and other industrial sites in smaller towns across Scotland. The commercial case is yet to be proven, but we are actively engaging across the sector.

4. Building the supply chain

Whatever the route to market for installing low and zero carbon forms of heat, lowering heat demand and taking advantage of waste industrial heat, it is clear that Scotland has a large opportunity to be involved in producing the products and services that will be needed in the transition. Not only technical hardware and product development, but there is also a need for digital and high tech solutions that provide an innovative approach to demand management, technical solutions or access to finance.

We have already made investments in the net zero heat supply chain (for example in Indinature and Sunamp) and will continue to invest in businesses who want to scale up to meet the growing demand either through providing products, or scaling up to provide the wide range of services needed to deliver the net zero heat and energy efficiency transition.

What is clear is that there is still much work to be done to decarbonise heat in building across Scotland. For this to happen new technologies and business models are likely to be required, so we believe there will be an important role for us, as Scotland’s development bank, to play.

We explore the challenges and opportunities for scaling businesses in our paper ‘Scaling Up Scotland’.